Tax Identifiers

Overview

When shipping internationally, there are many cases where you need to provide a tax identifier for the customs documents. Extensiv Order Manager allows these Tax IDs to be added to any international order for both the shipper (you) and the buyer (your customer/the recipient of the order).

NOTE

This article covers tax identifier functionality for Shipper Tax ID, NOT Buyer Tax ID. Currently, there is no automation built for Buyer IDs.

Set-Up

Access

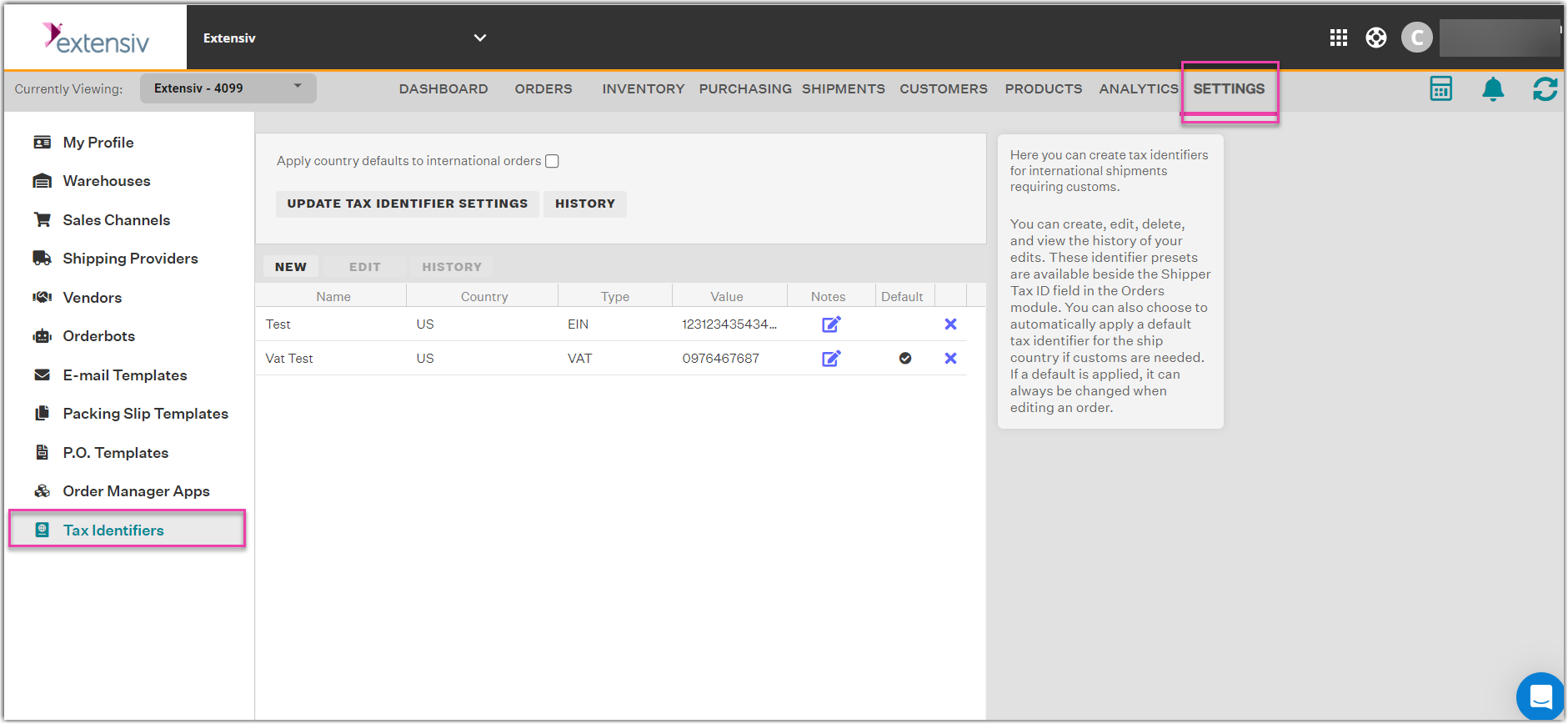

To access Tax Identifier settings, go to the Settings Module. At the bottom-left of the page, find Tax Identifiers and select it.

NOTE

You will need to have access to Shipping Providers in your User Administration / Permissions to view this page.

Settings

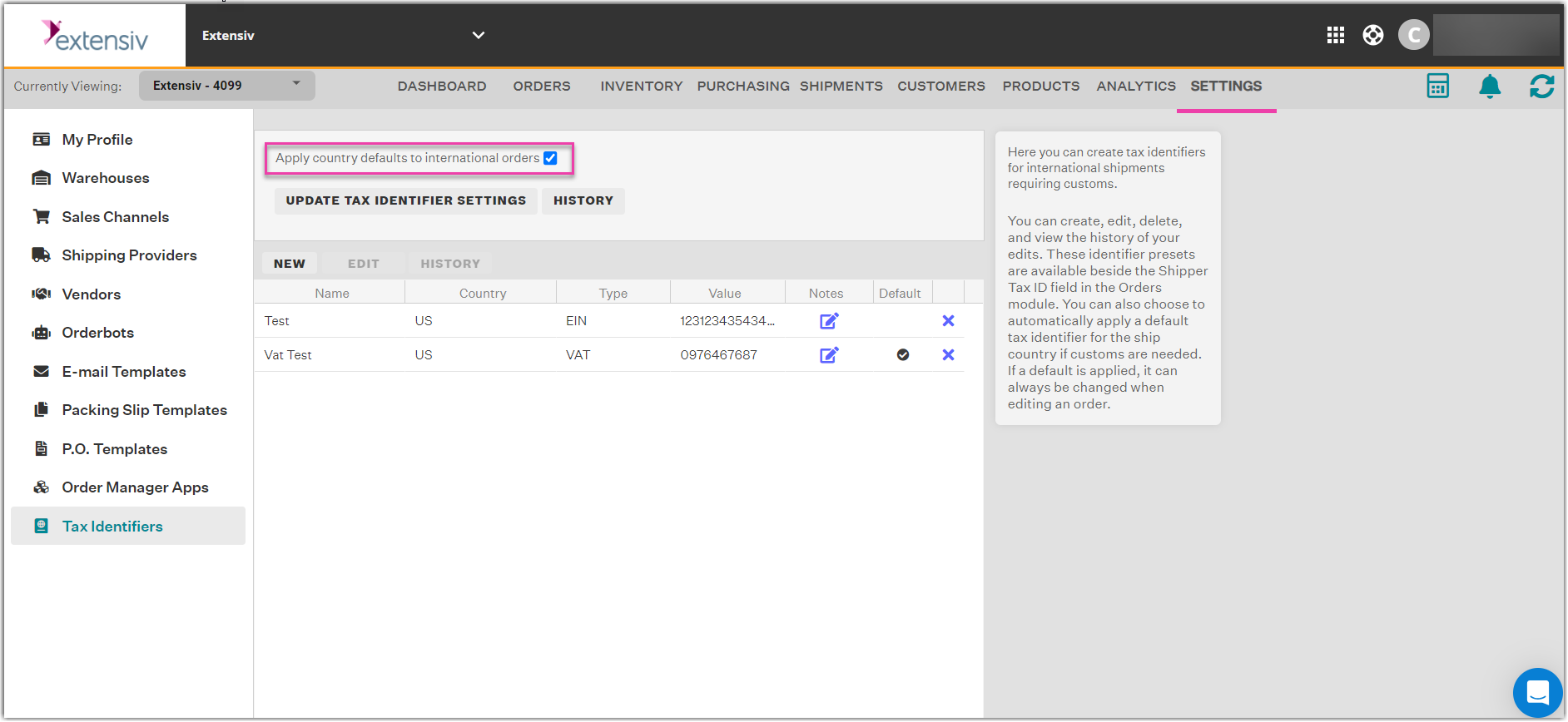

The only setting option is to Apply country defaults to international orders. After checking/unchecking this setting, you must click Update Tax Identifier Settings or your edit will not be saved.

- If selected, any Tax Identifier that is indicated as a Country Default in the grid will be utilized for shipments going to that Country. This is the Ship-To Country of an order.

- If unchecked, no automation will apply to your orders. You can still set Tax Identifiers individually in an order edit window.

The Grid

You can create new tax identifiers, edit and delete existing ones, and view the history for each.

Adding a New Tax Identifier:

- Click New

- Give the Tax Identifier a Name

- Select the Ship-To Country this Tax ID will be used for.

- Select the ID Type from the dropdown menu options

- Input an ID Value

- Enter any Notes you want for this Tax Identifier that can be viewed in the Grid.

- Indicate whether this Tax Identifier should be the Country Default or not.

Notes

- You can have multiple tax identifiers of the same type for the same country.

- You cannot have two identifiers with the same Name value regardless of Country or Type.

- You do not need to have a country default selected for a country, but you can only have ONE default.

- If you add/edit another tax identifier for the same country and mark it as the default, it will override the existing default.

ID Types

- None

- Other

- GST (Goods and Services Tax number)

- VAT (Value Added Tax number)

- EORI (Economic Operators Registration and Identification number)

- IOSS (Import One-Stop-Shop number)

- PAN (Permanent Account Number)

- EIN (Employer Identification Number)

Tax Identifiers in Action

In the Orders module, view an unshipped order with an international Ship-To Country. In the Processing tab, scroll to the bottom of the window. Here, you should see a section called Shipper Tax ID.

If the setting for Apply country defaults to international orders is checked on, then:

- If the Ship-To Country is one that has a Country Default set, the Type and ID field should be filled out.

- If the Ship-To Country is NOT one that has a Country Default set, then these fields will be blank.

Regardless of the setting, you can select from Preset options in the dropdown menu (Tax IDs), specifically for the Country that the order is set to ship to. You will not see any Preset options if you have not set up any Tax Identifiers in Settings for the Ship-To Country for the order. Buyer fields are NOT affected by the presets.

- If the Ship-To Country is the United States (indicating a domestic order) OR if it is blank, the Shipper Tax ID section will not be filled out.

- If the Ship-To Country is edited to a country you have a Country Default Tax Identifier for, then it will be filled in automatically.

- Edits to Tax ID inputs will be recorded in the Order Edit History